Mortgage Loans 101

Financial terminology can seem intimidating, and thinking about mortgages can be overwhelming. That is why we are here to guide you through the basics.

To help with the mortgage process, we’ve put together a few forms that you might need along the way, including a mortgage application. You can download and print these, but they should be completed with a Modus loan officer or any mortgage professional.

There Are 5 Parts To A Mortgage

Collateral

When you enter into the legal agreement with a lender, your house is used as collateral for that agreement. If you fail to pay back the loan, the bank can actually take your house back through a process called foreclosure.

Principal

The amount of money you borrow is the principal. To lower your loan’s initial principal amount, you can apply more of your funds to the purchase price of the home, referred to as a down payment.

Interest

The lender charges you for borrowing money from them. This is called the interest. It is typically expressed as a percentage, which is known as the interest rate.

Taxes

When you buy a home, the local community collects taxes based on a percentage of the home’s value. These taxes usually go to helping the community with education, roads, and more.

Insurance

Just like you have health insurance to cover you when you are sick, lenders will require you to buy home insurance. This insurance typically covers natural disasters, fire, theft, etc.

Collateral

When you enter into the legal agreement with a lender, your house is used as collateral for that agreement. If you fail to pay back the loan, the bank can actually take your house back through a process called foreclosure.

Principal

The amount of money that the bank lets you borrow is known as the principal. To lower your loan's initial principal amount, you can apply more of your funds to the purchase price of the home, referred to as a down payment.

Interest

The lender charges you for borrowing money from them. This is called the interest. It is typically expressed as a percentage, which is known as the interest rate.

Taxes

When you buy a home, the local community collects taxes based on a percentage of the home's value. These taxes usually go to helping the community with education, roads, and more.

Insurance

Just like you have health insurance to cover you when you are sick, lenders will require you to buy home insurance. This insurance typically covers natural disasters, fire, theft, etc.

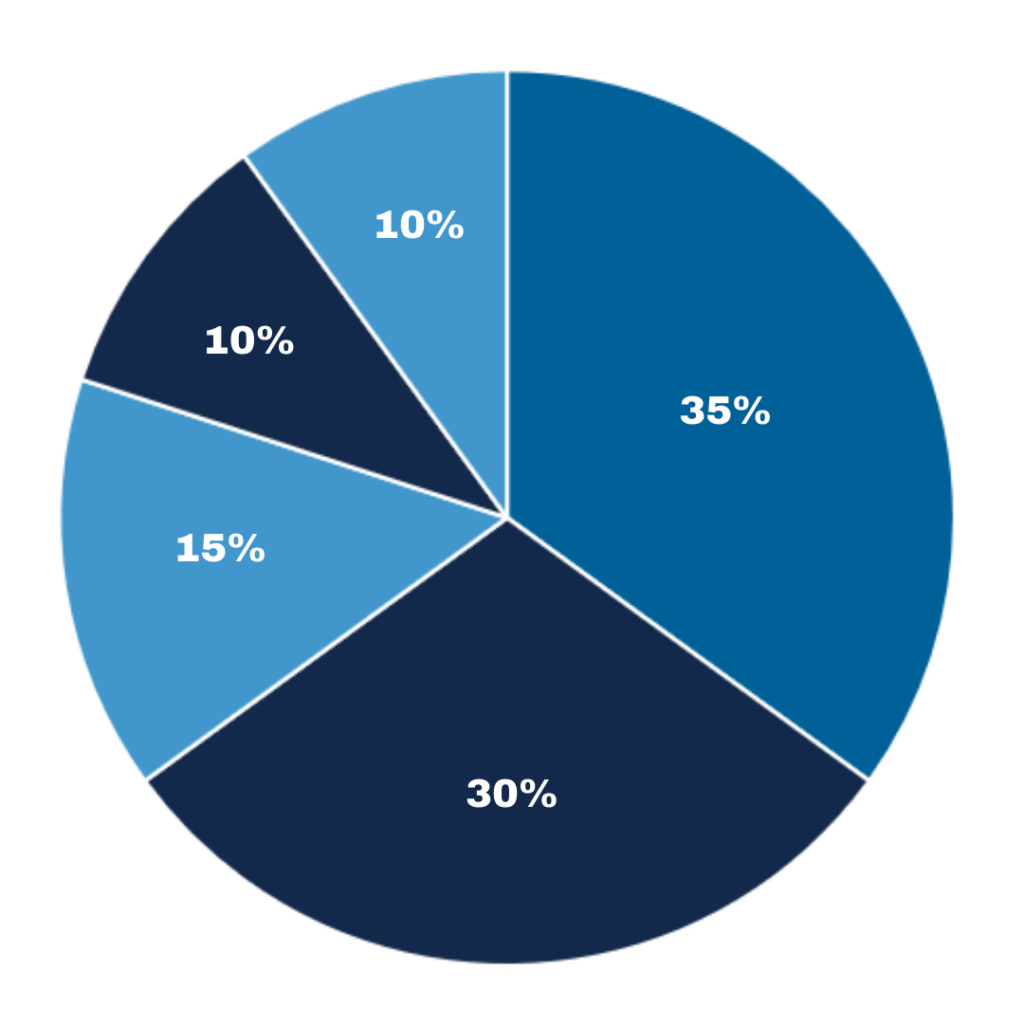

What Makes Up My FICO Score?

Understanding credit can be super challenging, so don’t worry if it’s a bit confusing. The best way to traverse the world of credit is to educate yourself. Credit can be built and repaired, but the key is to do it in a way that benefits your score.

For more information on credit or to find out how to improve your credit, visit 360 Credit Consulting online or call 833-231-1767

There are FIVE different factors that go into calculating your FICO score. To make things more confusing, each piece of the puzzle is a different size. Payment history is the largest piece, but how do credit mix, new accounts, or credit utilization fit in?

Payment History: 35%

Payment history makes up the largest FICO score factor. All late and on-time payments are taken into consideration.

Credit Utilization – 30%

The second-largest factor in calculating your FICO score is credit utilization. This is the amount you owe on your accounts compared to the total credit limits. Aim for 30% or less.

Length of Credit History – 15%

Coming at 15% of your score, length of credit history is the average length of both open and closed accounts.

Credit Mix – 10%

Believe it or not, the types of credit you hold influence about 10% of your score. Credit cards, loans, installments, etc. all factor in here.

New Credit Accounts – 10%

Included in this last factor are newly opened accounts AS WELL AS inquiries. Too many inquiries have a negative effect on your overall score.

Mortgage Application Checklist

You will need some essential documents and information to apply for a mortgage.

Personal Information

1. Personal Information

- Social Security number and date of birth. Required of you and any co-borrowers.

- Divorce or separation information. A copy of the divorce decree or maintenance agreement, along with any amendments and a 12-month payment history of alimony and/or child support payments, as well as documents if the payments are needed to verify your income and qualify for the mortgage.

- In-school/student information. School transcripts or diploma if you don’t have 2 years of employment history.

- Current housing information. For homeowners, your address, current market value, mortgage lender, account number, current monthly payment, and outstanding balance due on the mortgage. For renters, your address, the name and address of your landlord, proof of lease and your current monthly rent. If you’ve lived at your current address for less than 2 years, bring information for your previous addresses.

Employment Information

- Employer(s) verification. Names, addresses, and telephone numbers of your employers for the past 2 years.

- Income verification. Your 2 most recent pay stubs with year-to-date earnings.

- Self-employment documents. If self-employed, bring your profit and loss statement and balance sheet for the past 2 years.

Financial Information

- Tax information. W-2 tax forms and tax returns for the last 2 years.

- Bank account(s) information. Account number(s) and current balance(s) of your checking, savings, or any other account(s).

- Assets information. Statements of current assets, such as Individual Retirement Accounts (IRAs), Certificates of Deposit (CDs), stocks, and bonds. For individual investments, a current brokerage statement with the name of the stocks, the amount per share, and the number of shares owned.

- Personal property information. Disclosure of the value of your personal property, including employee retirement accounts, furniture, cars, any valuable collections, other valuable property, and life insurance.

- Credit information. Names and addresses of all creditors, and the monthly payment and total amount due for all current loans.

- Rental property information. Federal tax returns and a schedule of all real estate property you own, plus account number and address of the mortgage company if any property you own is not paid for. If the property is rented, provide a copy of the current lease

Information About The Home You Are Buying

- Recorded deed. Your deed will show the legal owner(s) of the property.

- Title Insurance. A copy of your title insurance will help the lender verify taxes on the property, and provide us with a legal description of the property.

- Homeowner’s Insurance. A copy of your homeowner’s insurance will show that you have sufficient insurance to cover your property.