100% Commission

$789 Transaction / Processing Fee

In-House Processing

Agent Partnership Program

Industry Leading CRM

LOS Software

24 Hour Commission Pay

Branding Flexibility

Why Join Modus

Our model is superior and simple

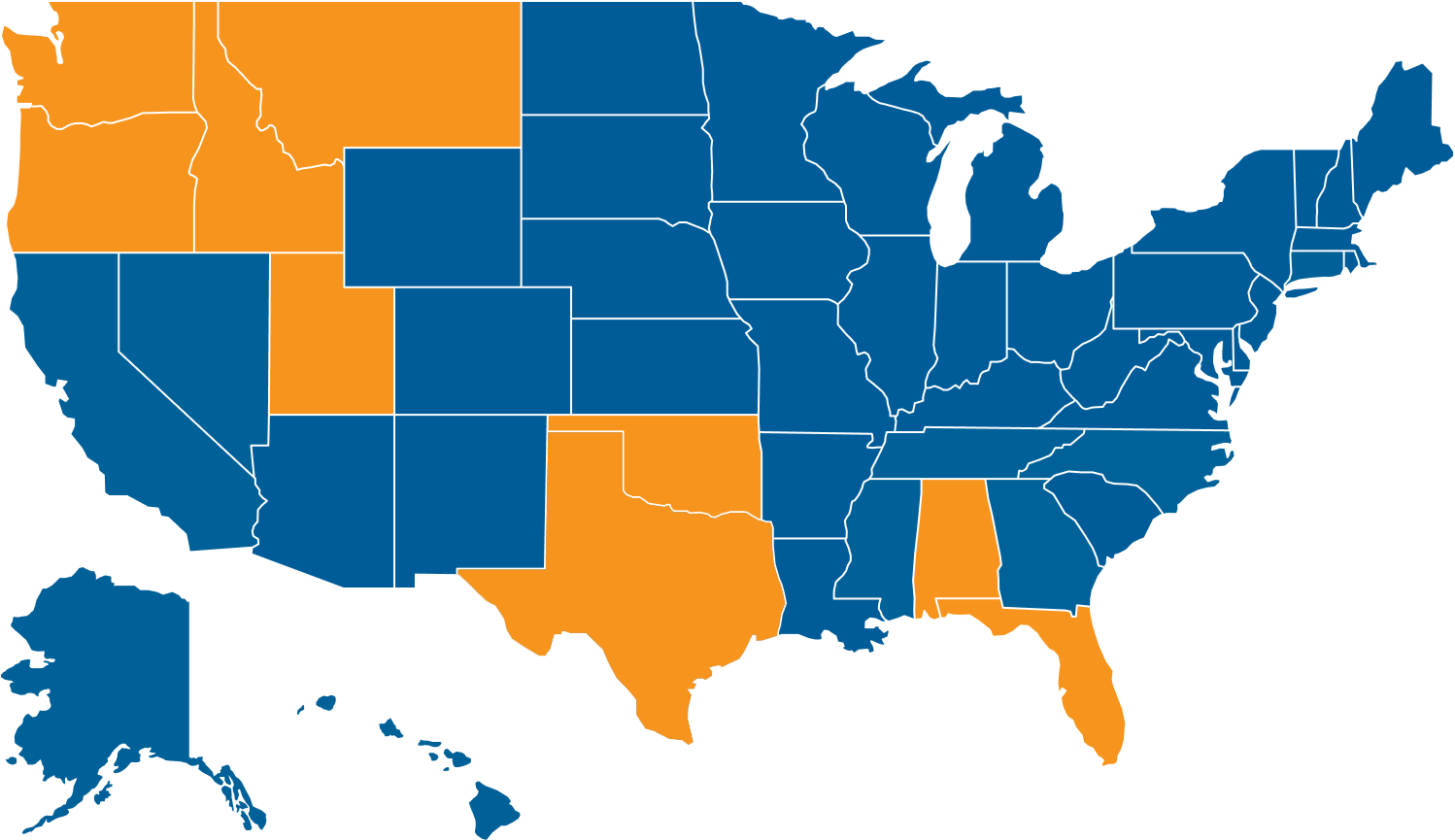

You keep 100% of your commision for one low fee with the flexibility to set your own organization fee. We have a network of over 1000 real estate agents across the nation to partner with and share marketing costs. We allow you to keep your own brand and/or brand yourself. Modus Mortgage provides top CRM and lead generation technology to manage and increase your business. You can use our LOS (Loan Origination Software) for no additional charge or use your own. The Modus processing team will handle your files and keep you compliant. This allows you more time to increase your business. Let our awesome support help you make more money!

Compare Modus Mortgage. See how we can help you thrive in an ever-changing market. Change to Modus today.

Earn More

Keep 100% of the commission you earn

It is simple. Keep 100% of the commission YOU earn! MLO’s pay Modus Mortgage $89 per month. You are also responsible for a $789 transaction fee per loan closed, which includes processing. Modus requires all files to go through our Modus Mortgage processing team. MLO’s will be responsible for their own credit reports and the fees associated with pulling credit reports. Finally, MLO’s must carry their own Errors and Omissions Insurance (We can help arrange).

Compare the Modus commission model to any mortgage broker in America! It is really that good. Please feel free to contact us with any questions or to set up a confidential call with one of our Designated Brokers.

Get Started

It’s a simple process to change to Modus

Please fill out the Modus Loan Officer Agreement Packet and submit along with a voided check and copy of your driver’s license to join@modusmtg.com. Once the completed items are received, we will send you a copy of your signed forms and onboard you with the NMLS. That’s it. Simple and secure. The NMLS will then report to your state agency that you are now a licensed MLO with Modus Mortgage.

- Modus Loan Officer Agreement Packet

- Scan of your Driver’s License

- Voided Check

- Loan Officer General Information/Licensing Information

- Independent Mortgage Loan Originator Agreement

- Compensation Agreement

- Automatic Billing Payment Plan

- Authorization for Direct Deposit

- W-9 Form

Request Info

We’re here to help

What Clients Are Saying

About US

Modus Mortgage

Modus Mortgage was founded in 2007. Modus is designed for mortgage professionals considering a new company to increase their success. In addition to our 100% commission structure, we focus on the latest technology, increased client satisfaction and extremely competitive rates. This attracts some of the most experienced mortgage loan originators in the industry. It is a win/win relationship and ultimately benefits our borrowers. Look closer at what Modus Mortgage provides and how Modus Mortgage can benefit you.